Automotive

From DIY consumers to professional workshops and dealer networks, automotive buyers expect accurate fitment, real-time availability, and frictionless ordering. Eltrino delivers modern eCommerce architectures that unify B2C storefronts with advanced B2B capabilities.

Automotive and Aftermarket eCommerce Challenges

Automotive and aftermarket buyers expect retail-grade UX with workshop-grade accuracy. Whether it’s a DIY customer repairing their car, a detailing shop ordering supplies, or a professional workshop sourcing components, they must be able to find the right part, the correct variant, and the exact paint colour match quickly and without extra effort.

With thousands of SKUs, supersessions, colour codes, and vehicle compatibility rules, the challenge is not just “having a catalog” - it’s delivering absolute fitment accuracy, correct colour/variant selection, and real-time availability across multiple warehouses and suppliers.

Automotive and aftermarket teams face challenges such as:

🚗 Fitment & data complexity

ACES/PIES, TecDoc/MAM, Make-Model-Year logic, VIN/VRM lookup, supersessions, compatibility rules, and ensuring every part and variant truly matches the customer’s vehicle.

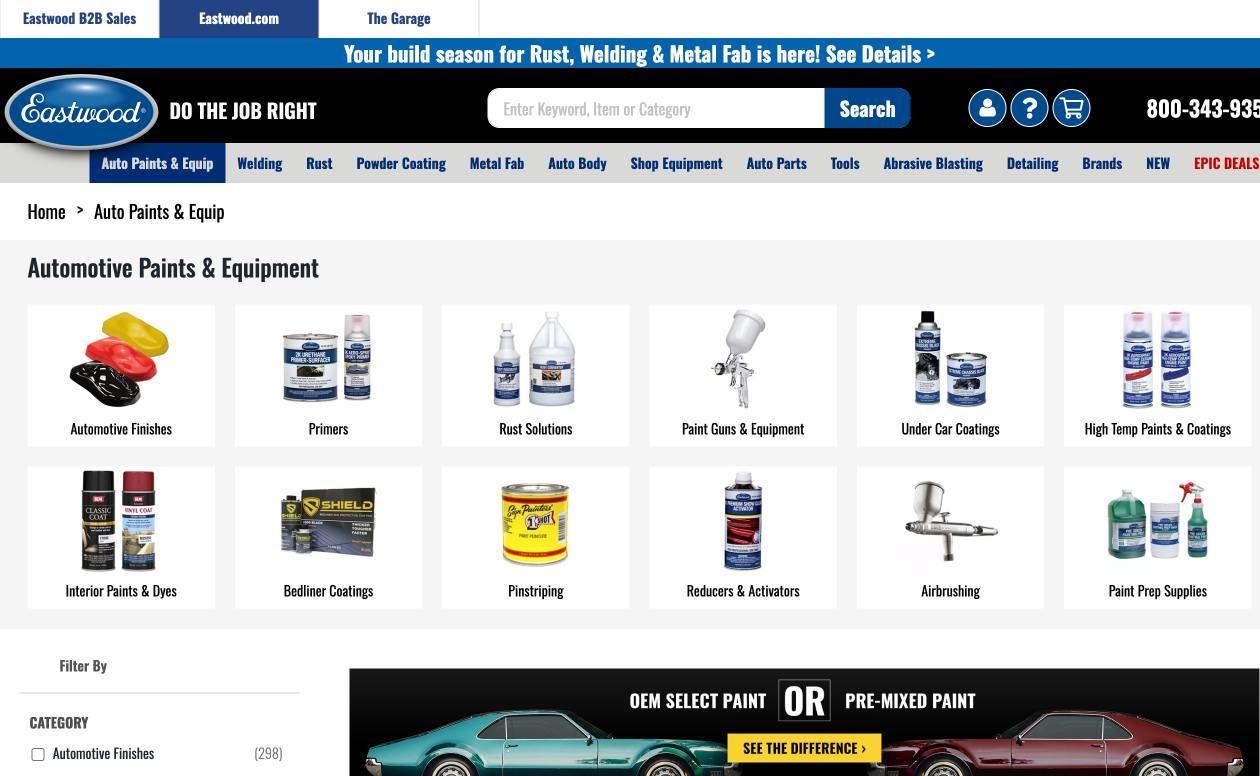

🎨 Search, variants & colour matching

MMY selectors, VIN/plate search, faceted filtering, part diagrams, and variant management - paint colours, finishes, trim variations, wheel sizes, kits, bundles, and accessory compatibility. It must be easy to navigate and error-proof.

🏭 Advanced B2B commerce

Tiered pricing, net terms, quotes, purchase lists, bulk ordering, workshop accounts, dealer catalog visibility, and punchout/cXML capabilities.

📦 Operations & logistics

Multi-warehouse stock, dropship + 3PL integrations, core returns, hazmat shipping (e.g., paints, chemicals), freight rules, and real-time inventory sync for large, fast-moving catalogs.

⚡ Performance & scale

High-SKU catalogs, seasonal spikes, international stores, and the need for ultra-fast search and product pages to support precise part and colour selection.

To succeed, automotive and aftermarket retailers need flexible, AI-ready architectures that make it easy to find the exact part, the correct configuration, and the perfect paint color. This approach also ensures operational accuracy in areas like fitment, logistics, B2B workflows, and performance at scale.

Most Valuable Trends in Automotive and Aftermarket eCommerce 2026

1. Digital becomes the default buying channel

Workshops, fleets, and DIY customers are all shifting to digital platforms for research, ordering, and replenishment. Traditional phone/fax ordering is being replaced by portals and marketplaces where availability, price, and fitment are instantly visible.

2. Fitment accuracy as a competitive advantage

With huge catalogs and complex compatibility rules, “does it fit my vehicle?” is the key question. Sellers differentiate with MMY/VIN/VRM flows, rich attributes, and clean ACES/PIES or TecDoc data, reducing returns and building trust.

3. B2B goes self-serve and omnichannel

Independent workshops and dealers expect account-based pricing, credit terms, quick order by SKU, and O2O options (order online, install locally). B2B growth is already outpacing its historical share of the online market.

4. AI-driven pricing, recommendations, and inventory

According to McKinsey, AI and machine learning in aftermarket pricing and revenue management can materially improve margins in a margin-squeezed sector.

5. Flexible, Integration-Ready Architecture

Automotive eCommerce evolves quickly - new marketplaces, O2O services, dealer portals, and fitment providers appear every year. Retailers increasingly need flexible architectures that can integrate PIM, ERP, WMS, fitment databases, and marketplace connectors without rebuilding their entire platform.

In 2026, the leaders in automotive and aftermarket eCommerce will be those who combine fitment intelligence, B2B self-service, AI-driven pricing and recommendations, turning complexity into a smooth, confident buying journey for both consumers and professionals.